On-Demand Pay Costs: What You Really Pay for Early Wage Access

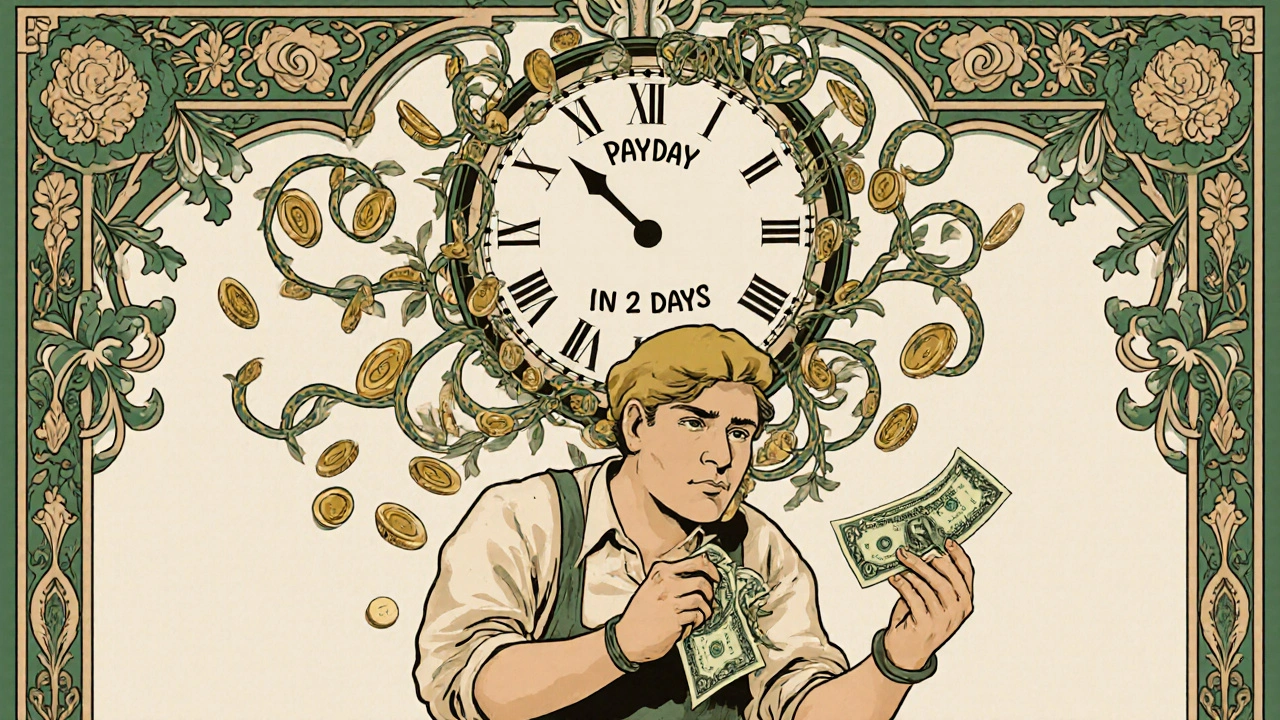

When you hear on-demand pay, a system that lets employees access earned wages before payday. Also known as earned wage access, it’s become a popular perk for gig workers, retail staff, and hourly employees who can’t wait two weeks for their next paycheck. But here’s the catch: what looks like a free benefit often comes with hidden costs — for both workers and employers.

Many platforms charge workers a fee to access their own money, sometimes $1 to $5 per transaction. That might seem small, but if you’re using it twice a week, that’s $8 to $40 a month — money that could’ve stayed in your pocket. Employers, meanwhile, pay for integration, compliance, and sometimes subsidize the service. And if you’re in a state with strict EWA laws, state regulations that control how wage access programs can operate, you could be facing fines or legal trouble if your setup doesn’t match the rules. States like California, New York, and Illinois have specific rules about fees, disclosures, and whether the program counts as a loan.

It’s not just about fees. There’s also the risk of dependency. If employees start relying on early access to cover every bill, they might never build a real emergency fund. And while earned wage access, a tool designed to reduce payday loan use and financial stress sounds like a win, it doesn’t fix the root problem: low wages and unpredictable income. Some companies use it as a band-aid instead of raising pay or offering better benefits.

That’s why understanding the real on-demand pay costs matters — whether you’re an employee trying to avoid sneaky fees, or an employer deciding whether to offer it. The best programs are transparent, no-fee, and paired with financial education. The worst ones turn early access into a trap.

Below, you’ll find real breakdowns of how these programs work across states, what employers get charged, how fees add up over time, and the legal gray areas no one talks about. No fluff. Just what you need to know before you sign up — or sign off.