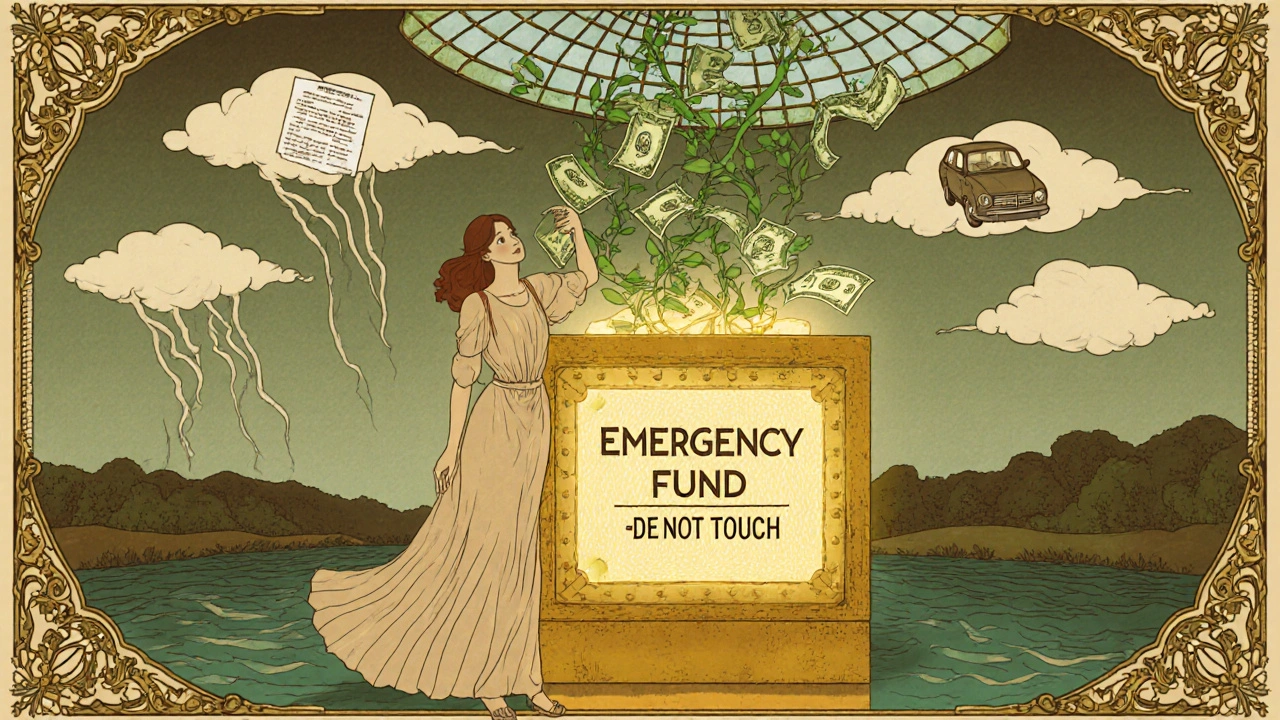

Emergency Savings Account: Build Your Financial Safety Net Today

When life throws you a curveball—a car repair, a medical bill, or a sudden job loss—an emergency savings account, a dedicated cash reserve meant for unexpected expenses. Also known as an emergency fund, it’s the one thing that stops a small crisis from becoming a financial disaster. You don’t need a fancy investment or a high income to start one. You just need to keep money somewhere safe, separate from your checking account, and leave it alone until you really need it.

Most people think they need $10,000 or more to feel safe. But the truth? A savings buffer, a small, accessible pool of cash for immediate emergencies of $1,000 to $2,000 can be enough to keep you out of credit card debt the first time something breaks. For freelancers and gig workers, that number jumps—because income isn’t steady. That’s why freelance savings, a tiered emergency system designed for irregular income often means three to six months of living expenses. It’s not about being rich. It’s about being ready.

Here’s what you’ll find in this collection: real stories and simple plans for building your emergency savings account—whether you’re paid weekly, monthly, or when clients actually pay you. We break down how to start with $5 a week, how to keep the money safe and separate, and how to avoid dipping into it for things that aren’t true emergencies. You’ll also see how fintech tools help automate the process, what banks and apps offer the best interest rates without hidden fees, and why even people with unstable income can build this safety net without waiting for the "perfect" time.

There’s no magic trick. No secret app. Just consistent habits, smart choices, and knowing that your future self will thank you when the unexpected happens. The posts below aren’t about getting rich. They’re about staying in the game—no matter what life throws at you.