Finance: Understand Money, Trading, and Investing Without the Jargon

When you think about finance, the management of money, investments, and financial planning over time. Also known as personal finance, it's not just about bank accounts or stock charts—it's about the choices you make every day that shape your financial future. Most people think finance means chasing quick wins or following market trends, but the real game is deeper. It’s about understanding your own behavior, building systems that work for you, and avoiding the traps that trip up even smart people.

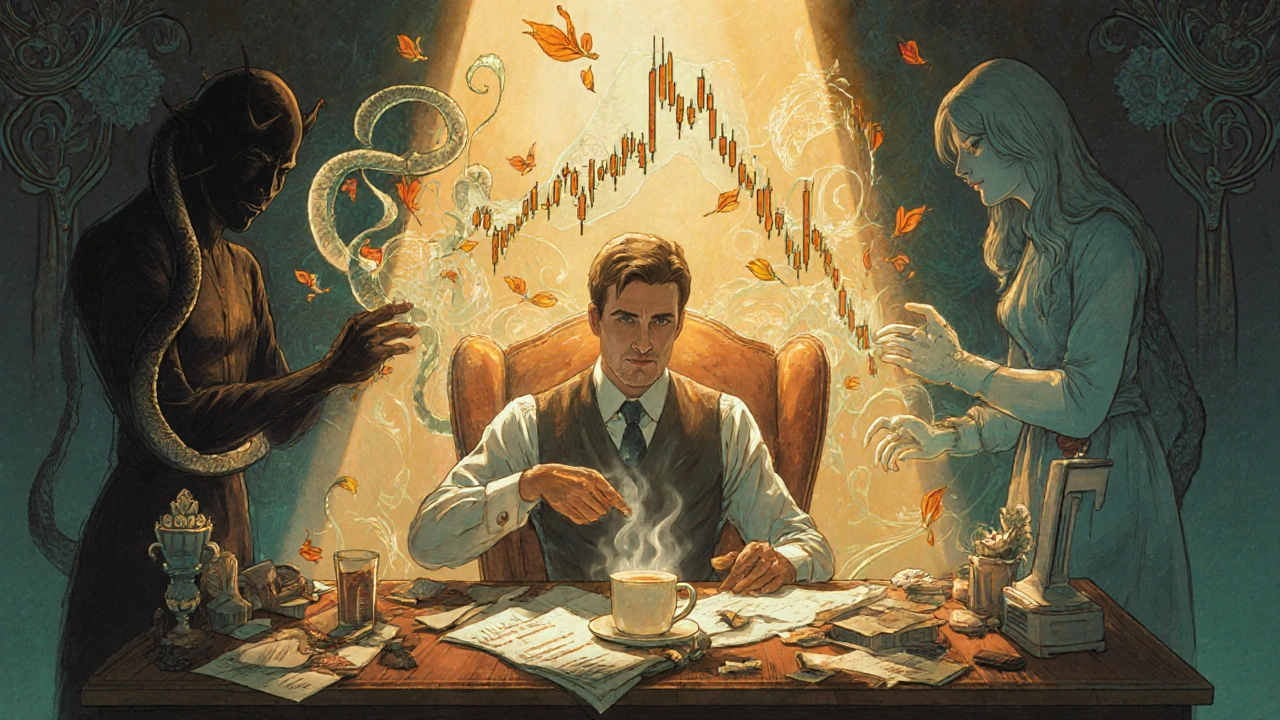

Take trading psychology, how your emotions affect your buying and selling decisions in markets. It’s not a soft skill—it’s the #1 reason people lose money, even when they have good strategies. Fear makes you sell low. Greed makes you buy high. Impatience makes you ignore your plan. And without a trading journal to track your moves, you’re just guessing what went wrong. Then there’s the confusion between trading vs investing, the difference between short-term market timing and long-term wealth building. One is like sprinting with no finish line. The other is planting trees you’ll never sit under—but your kids will. You don’t need to be a genius to win at investing. You just need consistency, patience, and the right mindset.

And what about the people you hire to help? financial advisors, professionals who offer guidance on money, taxes, and investments can be useful—but having three of them doesn’t mean you’re three times better off. It usually means you’re getting three different answers, paying for overlapping services, and spending more time in meetings than making progress. The goal isn’t to collect advisors. It’s to build a clear, coordinated plan that actually works.

These aren’t abstract ideas. They’re the same problems the posts below tackle head-on: why emotions ruin trades, how to tell if you’re trading or investing by accident, and how to stop advisor chaos from draining your time and money. You don’t need a finance degree to get this right. You just need to know what to look for—and what to ignore.