Investing vs Trading Growth Calculator

Your Investment Details

Trading vs Investing Comparison

The article explains that most retail traders lose money while long-term investors benefit from compound growth.

Long-Term Investing (50% Return)

Based on historical S&P 500 returns (9.84% average)

Short-Term Trading (5% Return)

Based on average retail trader returns (5% after fees)

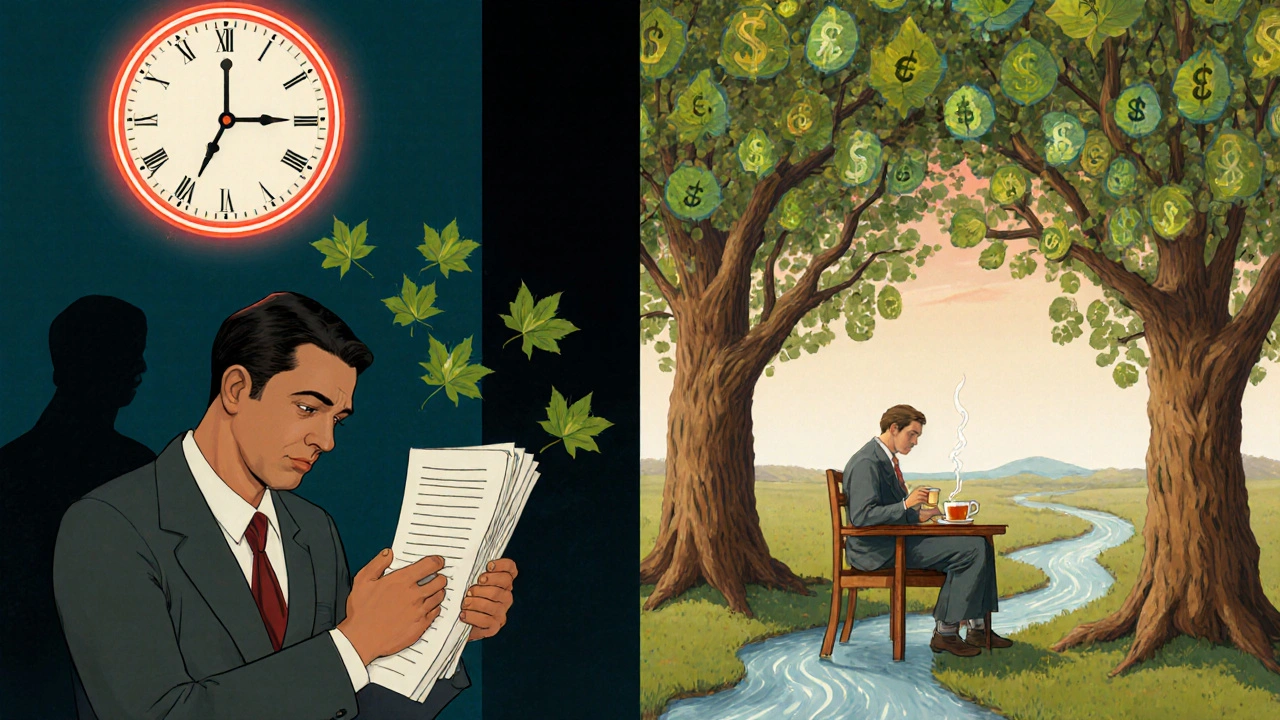

Most people think buying stocks is buying stocks. But if you’re trading a stock you bought yesterday and selling it today, or holding it for ten years because you believe in the company - those are two completely different games. One is about timing the market. The other is about letting time work for you.

Trading Is About Timing. Investing Is About Time.

Trading means buying and selling assets quickly - sometimes within minutes, sometimes within days. Day traders watch price charts, watch for patterns, and jump in and out based on short-term moves. Swing traders hold for a few days or weeks, hoping to catch a trend. Even if you hold for a month, you’re still trading if your plan is to sell before the company’s next earnings report or before interest rates change. Investing is the opposite. It’s about owning a piece of something and letting it grow over years, even decades. You’re not trying to guess what the price will be next week. You’re betting that the company will get bigger, earn more money, and pay more dividends over time. Warren Buffett didn’t become rich by trading. He became rich by holding Coca-Cola, American Express, and Apple for 20, 30, even 50 years. The difference isn’t just how long you hold. It’s your whole mindset. Traders react. Investors wait.How Much Time Do You Really Need?

If you’re trading, you’re on the clock. Day traders often spend 4 to 8 hours a day watching screens, checking news, adjusting orders, and reviewing their trades. That’s a full-time job. And it’s not just about skill - it’s about focus. One distraction, one missed signal, and you lose money. Investors? They check their portfolios once a month. Maybe once a quarter. If you’re using index funds - like Vanguard’s VTSAX - you might spend less than two hours a month managing your money. You set it up, automate your contributions, and forget about it. Then you go live your life. The time difference isn’t just about convenience. It’s about cost. Every trade you make costs money - even if it’s “commission-free.” Brokers make money on the spread, the difference between what they buy and sell. The more you trade, the more you pay. And that eats into your returns.What Tools Do You Actually Need?

Traders rely on technical analysis. That means looking at charts - moving averages, RSI, MACD, candlestick patterns. They’re trying to read the crowd’s mood. Is everyone buying? Are they scared? Is the price about to reverse? Over 65% of active traders use moving averages. Nearly half use the RSI indicator. These tools help them decide when to enter and exit. Investors use fundamental analysis. They look at financial statements. They check revenue growth. They look at profit margins. They ask: Does this company have a moat? Can it survive a recession? Is management honest and smart? They don’t care if the stock dropped 5% today. They care if the company’s earnings grew 10% last year. The tools are different. So are the skills. You don’t need to know how to read a balance sheet to trade. But you do need to know how to read a chart. And vice versa.

Risk Is Not the Same

Trading is risky. Not because the market is unpredictable - though it is - but because you’re trying to outsmart it. Most retail traders lose money. A 2022 FINRA study found that 78% of new retail traders quit within 18 months. Why? Because they lost money. Or they got stressed out. Or both. The data is brutal. A University of California study showed that 72% of active traders underperform the market after fees. Meanwhile, buy-and-hold investors in global stocks had positive returns in 83% of every 10-year period from 1900 to 2021. That’s not luck. That’s math. Trading often uses leverage - borrowing money to increase your bet. Some forex brokers let you trade with 30:1 leverage. That means if you put in $1,000, you can control $30,000. Sounds great - until the market moves against you. Then you lose everything - and then some. Investors avoid leverage. They use diversification instead. A simple portfolio of 60% stocks and 40% bonds reduces risk without sacrificing long-term growth. And they rebalance once a year. No panic. No emotion. Just discipline.Taxes Don’t Lie

Here’s something most beginners don’t think about until it’s too late: taxes. If you hold a stock for less than a year and sell it for a profit, the IRS treats it as ordinary income. That means you could pay up to 37% in federal taxes - same rate as your salary. If you hold it for more than a year? You pay long-term capital gains tax. For most people, that’s 15%. For lower incomes, it’s 0%. For the highest earners, it’s 20%. That’s a massive difference. Trade too often, and you’re handing over half your profits to the government. Invest patiently, and you keep most of it.

Who Wins in the Long Run?

The numbers don’t lie. The S&P 500 returned an average of 9.84% per year from 1926 to 2022 - including dividends. That’s compound growth. A $10,000 investment in 1980 would be worth over $1.2 million today. Meanwhile, most actively managed mutual funds fail to beat the S&P 500. According to S&P Dow Jones Indices, 88.3% of large-cap fund managers underperformed the index over 15 years ending in 2022. Even professional money managers - with PhDs, Bloomberg terminals, and teams of analysts - couldn’t beat a simple index fund. And yet, retail trading exploded during the pandemic. From 2019 to 2020, retail trading volume jumped 166%. Robinhood, eToro, and Webull gained millions of new users. Many of them thought they were investing. They weren’t. They were gambling. A Reddit user ran a 10-year backtest: his trading portfolio returned 8.2% annually. The S&P 500 returned 14.6%. He lost 44% of his potential gains just by trying to be smart.What Should You Do?

If you’re just starting out - and you’re not sitting in front of a screen 8 hours a day - invest. Start with a low-cost index fund. Set up automatic contributions. Let your money grow. Don’t check it every day. Don’t try to time the market. Just keep adding to it. If you want to trade - go ahead. But know what you’re getting into. Treat it like a hobby, not a career. Put only money you can afford to lose. Learn the tools. Practice with a simulator first. And never, ever use leverage unless you fully understand how it can destroy you. Most people don’t need to trade. They need to invest. The market isn’t a casino. It’s a wealth-building machine. But only if you let it work over time.Start Simple. Stay Consistent.

You don’t need to pick the next Apple. You don’t need to master candlestick patterns. You don’t need to watch the news all day. You just need to start. Open an account with a low-cost broker. Buy an S&P 500 index fund. Set up a $50 or $100 automatic deposit every month. And then - and this is the hard part - do nothing. Let compound interest do the work. Let time be your advantage. Let patience be your strategy. Because in the end, the best investor isn’t the one who makes the most trades. It’s the one who makes the fewest - and sticks with it.Can you do both trading and investing?

Yes, but keep them separate. Use a small portion of your portfolio - say 10% - for trading. Treat it like a learning exercise or a hobby. Keep the rest in low-cost index funds for long-term growth. Never let trading interfere with your core investing strategy. Mixing the two often leads to emotional decisions and underperformance.

Is day trading profitable?

For most people, no. Studies show that 70-80% of retail day traders lose money after fees and taxes. The few who succeed are usually full-time professionals with advanced tools, deep experience, and strict risk controls. For the average person, day trading is more likely to cost money than make it. The odds are stacked against you.

What’s the best way to start investing?

Start with a target-date fund or a total stock market index fund like VTSAX. These funds hold hundreds or thousands of stocks automatically. They have low fees - as low as 0.03% - and require almost no management. Set up automatic monthly contributions. Increase them when you get a raise. That’s it. No research needed. No timing required. Just consistency.

Why do so many people lose money trading?

Because they trade emotionally. They buy when everyone’s excited. They sell when they’re scared. They chase hot stocks. They use leverage. They don’t have a plan. Trading requires discipline, patience, and a deep understanding of risk - qualities most beginners don’t have. Investing, by contrast, removes emotion by design.

Do I need a lot of money to start investing?

No. Thanks to fractional shares, you can start with $1. Platforms like Robinhood, Fidelity, and Charles Schwab let you buy fractions of a stock or ETF. You don’t need $1,000 to invest in Apple or Amazon. Just start small, stay consistent, and let time do the rest.

Is investing only for rich people?

No. Investing is for anyone who wants to build wealth over time. You don’t need to be rich. You just need to be consistent. The average person who saves $200 a month and invests it in an index fund for 30 years will have over $400,000 - even with modest returns. Wealth isn’t about how much you make. It’s about how much you keep and grow.

Laura W

Bro, I used to think I was an investor until I realized I was just a day trader with a 3-day hold. Bought Tesla at 250, sold at 300, then watched it hit 900. Now I just throw money into VTI and go hiking. Time is the ultimate arbitrage.

Stop checking your portfolio like it’s a Snapchat streak.