Credit Score Improvement Estimator

Your Credit Building Calculator

Key Factors That Influence Your Score

Based on the article:

- Payment history: Accounts for 35% of your score - always pay on time

- Credit utilization: Keep below 30% (ideally 10%) of your limit

- Card type: Secured cards typically yield better results than unsecured

Estimated Credit Score Improvement

Building credit doesn’t happen by accident. If you’re starting from scratch or recovering from missed payments, traditional credit cards won’t approve you. That’s where credit-building credit cards come in. These aren’t just another credit card-they’re designed to help you prove you can handle credit responsibly. And if you use them right, they can lift your score by dozens of points in under a year.

What Exactly Is a Credit-Building Credit Card?

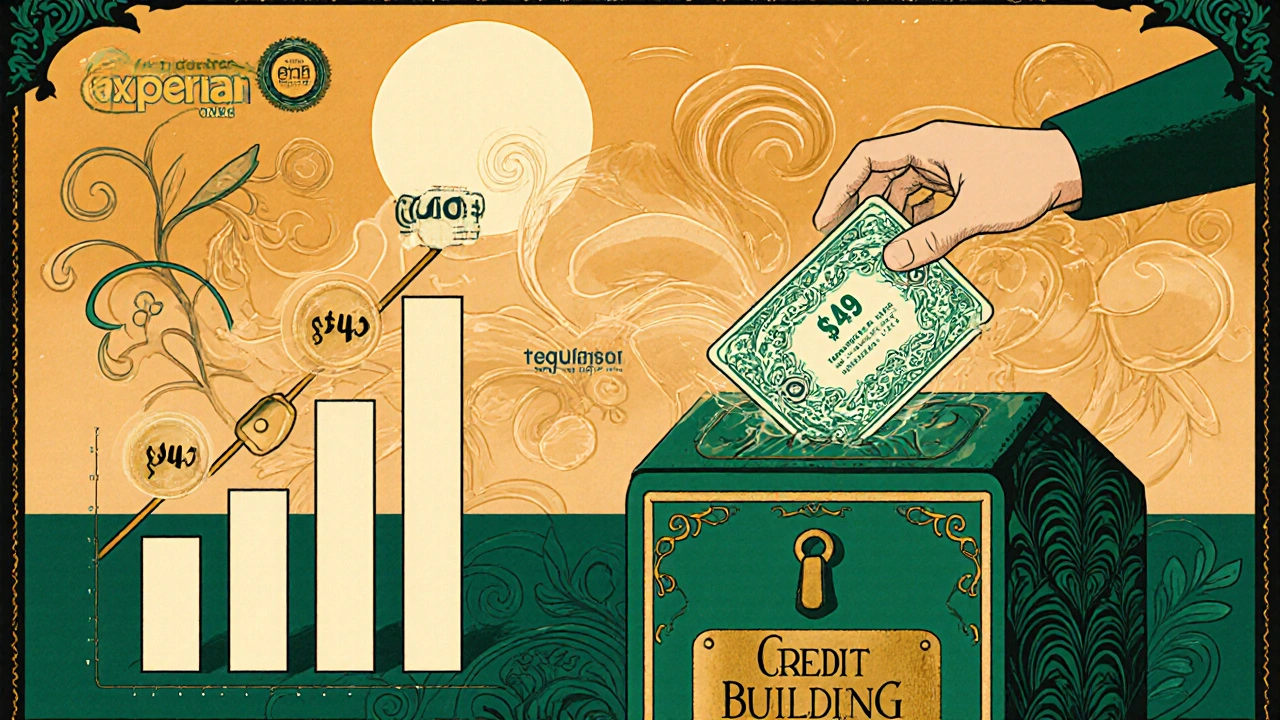

A credit-building credit card is a tool made for people with little or no credit history, or scores below 630. Unlike regular credit cards, these are built to report your payment behavior to all three major credit bureaus: Experian, TransUnion, and Equifax. That’s the key. If a card doesn’t report to all three, it won’t help your score much-no matter how well you pay. There are two main types: secured and unsecured. Secured cards require a refundable deposit-usually $200 or more-that becomes your credit limit. Unsecured cards don’t need a deposit, but they often come with high fees and interest rates. Both types work the same way: you use the card, pay on time, and the bureaus record it as positive behavior.Secured Cards Are Still the Best Starting Point

If you’re new to credit or rebuilding after bankruptcy, a secured card is your safest bet. Why? Because they’re easier to get approved for, and they teach you discipline. You can’t spend more than you’ve deposited, so there’s less risk of falling into debt. The Capital One Platinum Secured Credit Card is one of the most popular. You only need a $49 deposit to get a $200 credit line. There’s no annual fee. And after as little as six months of on-time payments, Capital One may automatically raise your limit-no extra deposit needed. That’s rare. Most issuers make you request an increase. The Discover it® Secured Credit Card is another top pick. It also starts at $200, and it gives you cash back-1% on all purchases, and 2% at gas stations and restaurants. Even better: Discover automatically reviews your account after eight months. If you’ve paid on time, they may upgrade you to an unsecured card and return your deposit. In 2025, Discover reported users saw an average 9-point score boost in just six months.Unsecured Cards Are Riskier-But Sometimes Necessary

If you don’t have cash for a deposit, unsecured credit-building cards are an option. But they come with serious trade-offs. The Revel® Platinum Mastercard® has a 35.90% fixed APR and a $125 annual fee after the first year. That’s not a mistake-it’s the reality. These cards charge high rates because they’re lending to people with higher risk. The FIT™ Platinum Mastercard® is similar: $125 annual fee after year one, and only a 47-point average score increase after 12 months. Why so low? Because many users end up paying more in fees than they benefit from credit growth. If you can’t pay off your balance every month, you’ll be stuck paying interest that eats away at your progress. Unsecured cards are only worth it if you’re confident you can pay in full each month. Otherwise, stick with a secured card-even if it means saving up a deposit first.What to Look for Before You Apply

Not all credit-building cards are created equal. Here’s what actually matters:- Reports to all three bureaus-If it doesn’t, skip it. Experian says this is the #1 factor in building credit.

- No annual fee-You’re trying to build credit, not pay for the privilege. Cards like Capital One Platinum Secured have $0 fees.

- Upgrade path-Look for cards that automatically review your account after 6-12 months. Discover and Capital One do this. Many others don’t.

- Low APR-Even if you plan to pay in full, mistakes happen. A 13.99% APR (like the First Progress Prestige Secured) is far better than 35.90%.

- Free credit monitoring-Capital One’s CreditWise and Discover’s free FICO Score access help you track progress without extra cost.

How Fast Can You Actually Improve Your Score?

There’s no magic timeline. But real data shows what’s possible:- With the Discover it® Secured, users averaged a 92-point increase after 12 months of responsible use.

- On the Capital One Platinum Secured, users reported jumps from 580 to 720 in 18 months.

- Users of high-fee cards like FIT™ Platinum saw only 47-point gains-because fees and interest made it harder to pay down balances.

Common Mistakes That Hurt Your Progress

People think just having a credit card will fix their score. It won’t. Here’s what goes wrong:- Maxing out the card-Spending your full limit kills your score. Even if you pay it off, the balance reported to bureaus is what counts.

- Missing payments-One late payment can drop your score 100+ points. Set up autopay.

- Applying for too many cards-Each application triggers a hard inquiry. Too many in a short time makes you look desperate. Apply for one, wait six months, then consider another.

- Closing the card too soon-Your credit history length matters. Keep the card open even after you’re upgraded. It helps your average account age.

Who Should Avoid These Cards?

These cards aren’t for everyone:- If you have good credit (700+), you don’t need one. You’ll get better rewards and lower rates elsewhere.

- If you can’t afford to pay your balance in full, avoid unsecured cards with 35% APRs. You’ll pay more in interest than you gain in credit.

- If you’re trying to build business credit, these won’t help. They’re for personal use only.

Real Stories, Real Results

One Reddit user, u/CreditBuilder2025, started with a $200 secured card after bankruptcy. They paid on time every month, kept spending under $50, and within 18 months, their score jumped from 580 to 720. They got approved for a no-fee rewards card and closed their secured card. Another user on Trustpilot said they were denied every card for three years. Then they got the Capital One Platinum Secured. Six months later, they were offered a $1,500 unsecured limit. They didn’t have to ask-they just got the upgrade automatically. But not everyone wins. One user on Reddit said their Revel® card had a $125 fee and 35% APR. They charged $300 for groceries and couldn’t pay it off. The next month, they owed $350. Their score dropped. They regretted choosing the unsecured card.What Comes Next?

Once you’ve built your score to 670+, you’ll start seeing offers for better cards. That’s the goal. Don’t rush it. Keep using your credit-building card responsibly. Pay on time. Keep balances low. Let your history grow. When you’re ready, you can switch to a cash back card, travel card, or even a 0% APR balance transfer card. But you won’t get there without starting somewhere. And for most people, that somewhere is a secured credit card.Final Tip: Use Free Tools to Track Progress

You don’t need to pay for credit scores. CreditWise from Capital One and Discover’s FICO Score access give you free updates every month. Check your score every 30 days. If it’s going up, you’re doing it right. If it’s flat or falling, look at your spending and payments. The credit-building card isn’t the end goal. It’s the first step. And if you use it wisely, it can open doors you didn’t think were possible.Can I get a credit-building card with no deposit?

Yes, but only through unsecured credit-building cards like the Revel® Platinum Mastercard® or FIT™ Platinum Mastercard®. These don’t require a deposit, but they often charge high annual fees (up to $125) and APRs as high as 35.90%. They’re riskier and more expensive. If you can afford a deposit, a secured card is almost always a better choice.

How long does it take to build credit with a credit-building card?

You can start seeing improvements in as little as 3-6 months with consistent on-time payments and low credit utilization. Most users see a 50-100 point increase within a year. To qualify for unsecured cards or better rates, aim for 12-24 months of responsible use. Building credit is a marathon, not a sprint.

Do credit-building cards help if I have bad credit?

Yes. These cards are designed specifically for people with bad or no credit. The key is using them responsibly: pay on time, keep your balance low, and avoid new debt. Cards that report to all three bureaus will help rebuild your score over time. Experian reports that 78.4% of users successfully transition to unsecured cards within two years.

Is it better to have a secured or unsecured credit-building card?

For most people, secured cards are better. They’re easier to get, have lower fees, and force you to spend only what you can afford. Unsecured cards are riskier because of high interest and fees. Unless you have no savings at all, a secured card gives you more control and better long-term results.

Will I get my deposit back?

Yes-if you close the account in good standing or get upgraded to an unsecured card. Most issuers, like Capital One and Discover, return your deposit automatically when you qualify for an upgrade. You don’t need to ask. Just keep making on-time payments and avoid maxing out your card.

Can I use a credit-building card to pay bills?

Yes, and it’s a smart way to build credit. You can use it for rent (if your landlord accepts credit cards), utilities, or subscriptions like Netflix or Spotify. Just make sure you pay the balance in full each month. This shows consistent, responsible use without adding debt. Many users report faster score growth when they treat their credit card like a debit card.

What if I can’t afford a deposit?

If you can’t afford a deposit, consider the Self Visa® Credit Builder Card. Instead of a deposit, you pay into a savings account over 12-24 months. Once you’ve made all payments, you get the money back and can use it as a deposit for a traditional card. It’s slower, but it works if you have no cash upfront. Avoid unsecured cards with 35% APRs-they’ll cost you more than they help.

Kenny McMiller

Look, credit-building cards aren't magic-they're behavioral scaffolding. The real leverage isn't the deposit or the APR, it's the reporting mechanism. If your card doesn't ping all three bureaus, you're just paying for plastic that whispers to the void. Capital One and Discover win because they don't just report-they *optimize* for behavioral feedback loops. You're not building credit; you're training your financial nervous system. And that 10% utilization rule? That's not advice, it's biofeedback. Your score is a mirror of your restraint. Stop thinking of it as a tool. Think of it as a mirror.