Advisor Coordination Efficiency Calculator

Calculate Your Advisor Coordination Costs

The article explains how poor coordination between multiple advisors can cost you time and money. This calculator estimates your potential coordination costs and shows savings from implementing a primary advisor model.

Coordination Efficiency Assessment

Based on your inputs and industry data from the article, here's what we found:

Current Annual Cost

$0.00

Potential Annual Savings

$0.00

Recommendation

Your current setup shows no significant coordination costs.

When you hire more than one financial advisor, you expect better service. More experts. More coverage. More peace of mind. But in reality, many people end up with confusing advice, repeated meetings, and information falling through the cracks. It’s not that the advisors are bad-it’s that the system isn’t built to handle multiple people working on the same financial picture.

Why More Advisors Doesn’t Mean Better Results

It sounds logical: if one advisor is good, two must be better. But research shows that adding a second lead advisor often hurts performance, not helps it. A 2023 analysis of over 850 registered investment firms found that teams with one lead advisor and three support staff generated 32% more revenue per professional than teams with two or more lead advisors sharing clients. Why? Because coordination eats up time-and time is money. When two advisors both meet with the same client, both update separate notes, and both try to manage the same account, you’re not getting double the value. You’re getting double the confusion. One advisor might recommend selling a stock. Another might say hold. The client doesn’t know who to trust. And the advisors? They’re spending nearly 20 hours a week just trying to sync up-time that could’ve been spent growing the client’s portfolio.The Hidden Costs of Shared Clients

The biggest drain on productivity comes from two invisible taxes: the Meeting Overlap Tax and the Shared-Clients Tax. The Meeting Overlap Tax happens when multiple advisors attend the same client meeting. Maybe one is there for investments, another for taxes, another for estate planning. But if they’re all just listening and not adding new value, you’re paying for three people to sit in the same room. One firm switched from a 2+2 model (two leads, two support) to a 1+3 model (one lead, three support) and saw revenue per advisor jump 29% in 18 months-simply by eliminating duplicate meetings. The Shared-Clients Tax is even worse. It’s the time spent emailing, calling, and scheduling just to make sure everyone’s on the same page. One advisor updates the client’s retirement goal. Another doesn’t know. So they propose a new strategy that contradicts it. The client has to explain everything again. The advisors have to backtrack. This isn’t collaboration-it’s chaos.Who’s in Charge? The Problem of Ownership

In a well-run team, there’s always one person who owns the client relationship. That doesn’t mean they do all the work. It means they’re the point person. They decide who gets involved, when, and why. They make sure nothing slips through. Without clear ownership, clients get confused. A 2025 survey by the Investments & Wealth Institute found that 63% of clients on multi-advisor teams couldn’t say who their primary contact was. That’s not just annoying-it’s risky. If something goes wrong, who do you call? Who’s accountable? If no one is clearly in charge, no one feels responsible. Firms that use a “primary advisor” model reduce coordination time by 41%. That’s not magic. It’s structure. The lead advisor doesn’t need to be the expert on everything. They just need to know who is-and make sure the pieces fit together.

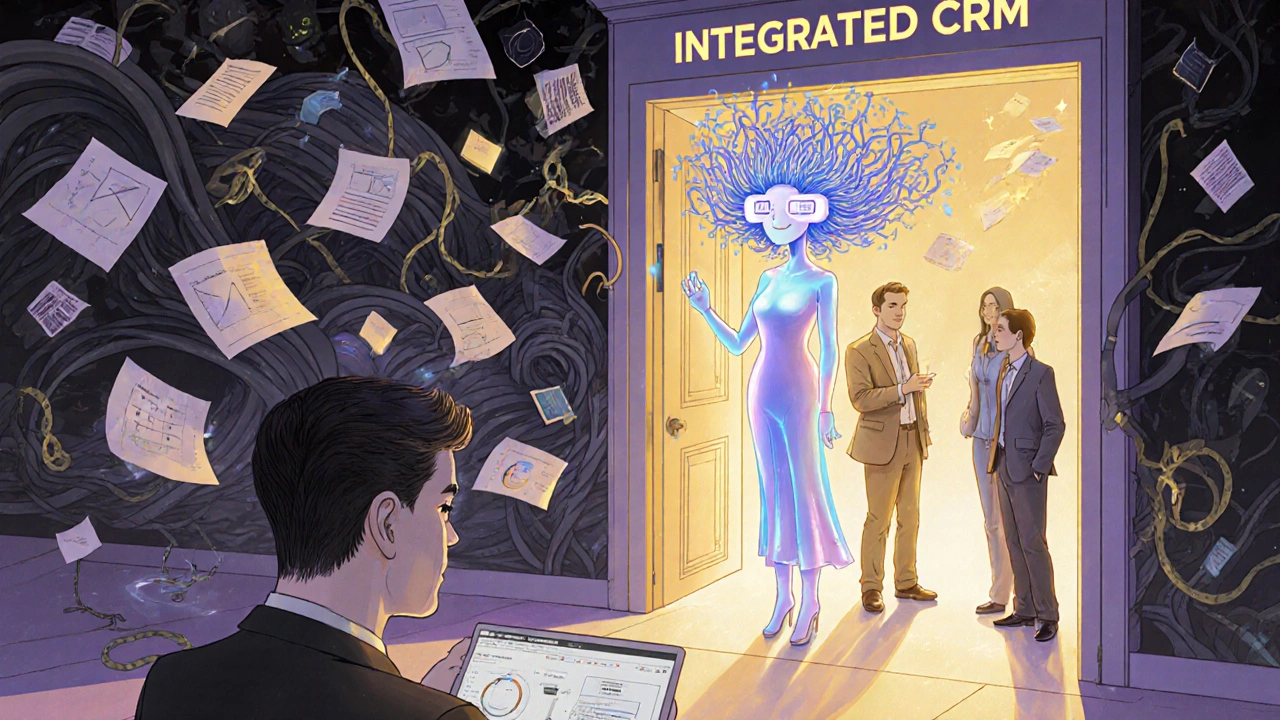

Technology Can Help-If It’s Used Right

You can’t fix coordination with more meetings. You fix it with better tools. CRM systems like Redtail CRM’s Team Coordination Module (released in late 2023) now flag duplicate meetings before they happen. They auto-sync client notes across advisors. They even show which advisor last spoke with the client and what was discussed. Firms using these tools cut duplicate scheduling by 67% in beta tests. In academia, universities using platforms like EAB’s Navigate reduced information silos by 53%. The same principle applies in finance. If your tax advisor, investment advisor, and estate planner are all using different systems, you’re setting yourself up for failure. Look for platforms that connect all your advisors under one roof-literally. Integrated systems let everyone see the full picture without needing to ask for updates. But here’s the catch: 72% of advisors say current tech creates more complexity than it solves. Why? Because too many tools don’t talk to each other. If your advisor uses one platform and your CPA uses another, you’re still stuck playing phone tag. Demand integration. Ask: “Can all my advisors access the same client file?” If the answer is no, you’re not getting a team-you’re getting a group of freelancers.AI Is Starting to Step In

New tools are emerging that don’t just store information-they analyze it. Envestnet’s AdvisorSync AI, launched in early 2024, scans calendars and client notes to spot potential conflicts before they happen. If two advisors are about to schedule conflicting meetings with the same client, the system alerts them. If one advisor recommends a change that contradicts another’s advice, it flags it. In pilot programs, it reduced duplicate meetings by 52%. Salesforce’s Financial Services Cloud 4.0, released in April 2024, maps how clients interact with different team members over time. It learns patterns. If a client always calls the estate planner after a market drop, the system suggests the investment advisor follow up with a quick check-in. It doesn’t replace human judgment-it makes it smarter. But AI won’t fix a broken system. If your team has no process for handing off tasks or updating notes, AI will just highlight the mess. Technology is a tool, not a cure. The real fix is clear roles, consistent communication, and a single source of truth.

What You Should Do Right Now

If you’re working with multiple advisors, here’s what to check:- Who is your primary advisor? They should be the one managing your overall plan and coordinating everyone else.

- Are you being billed for multiple advisors on the same meeting? If yes, ask why. You shouldn’t pay for redundancy.

- Do all your advisors use the same system? If not, insist on it. You shouldn’t have to repeat your life story to each one.

- Has anyone mapped out who does what? A simple document listing each advisor’s role-“John handles investments, Sarah manages taxes, Mike handles estate planning”-can prevent 80% of confusion.

- Do you ever get conflicting advice? If yes, that’s not a sign of expertise-it’s a sign of poor coordination.

When Multiple Advisors Actually Work

There’s a time when having multiple specialists makes perfect sense: when your situation is complex. High-net-worth clients with portfolios over $5 million often benefit from teams with dedicated experts-one for taxes, one for estate planning, one for investments. But even here, the key is structure. These teams succeed only when:- One lead advisor owns the overall plan

- Each specialist works within defined boundaries

- There’s a weekly sync to align on changes

- Client notes are updated in real time

Katie Crawford

I'm a fintech content writer and personal finance blogger who demystifies online investing for beginners. I analyze platforms and strategies and publish practical, jargon-free guides. I love turning complex market ideas into actionable steps.

view all postsWrite a comment