Author: Katie Crawford

Waitlist launches turn curious visitors into loyal customers by building hype, validating demand, and creating community before product launch. Learn how to use scarcity, social proof, and engagement to drive 30%+ higher sales on day one.

Rebalancing with options overlays like collars and puts helps institutional investors maintain target allocations without costly trades. By using out-of-the-money puts and calls, portfolios stay on track with less risk, lower costs, and no emotional decisions.

Guardrails and buckets are two modern strategies for rebalancing retirement portfolios. Guardrails adjust spending based on market swings, while buckets separate money by when you'll need it. Both help you avoid running out of cash - and both work better together.

Learn how to time your investment gains to pay zero capital gains tax using rebalancing, bracket filling, and the 0% tax rate window. A practical guide for U.S. investors to maximize after-tax returns without risky market timing.

Multi-factor authentication (MFA) is essential for fintech security. Learn which methods actually work, which to avoid, how to roll it out without user backlash, and why passwordless is the future.

APIs and SDKs serve different roles in fintech development. Learn when to use each for secure, scalable, and compliant financial apps-based on real-world performance, cost, and regulatory data.

Account takeover attacks are exploding in fintech. Learn how real-time behavioral biometrics, FIDO2 authentication, and device fingerprinting stop hackers before they steal money-without frustrating real users.

Third-party risk is one of the biggest threats to fintech security. Learn how vendor security assessments and continuous monitoring work, what frameworks to use, and how to avoid costly breaches from external vendors.

Qualified dividend income is taxed at lower rates than ordinary dividends - 0%, 15%, or 20% - based on your income. Learn how to qualify, avoid common mistakes, and maximize your tax savings in 2025.

REITs let you invest in real estate without buying property. Get rental income, diversification, and liquidity through publicly traded trusts. Learn how they work, which types to choose, and how to avoid common pitfalls.

ECOA compliance is now critical for fintech lenders. Learn how the law applies to small business loans, what the CFPB is enforcing in 2025, and how to avoid costly penalties from algorithmic bias and improper notices.

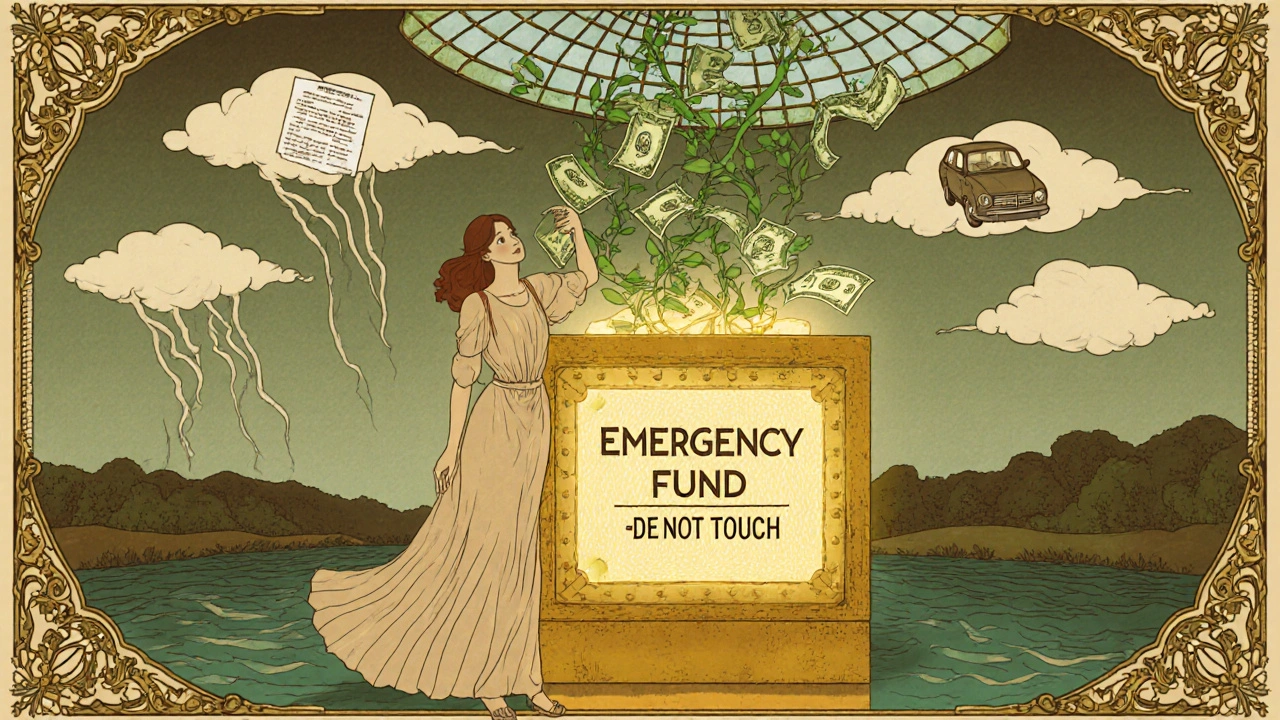

Learn how much to save for an emergency fund, where to keep it safely, and how to build it even on a tight budget. Avoid debt and gain peace of mind with a real, accessible safety net.