EMI vs PI Licensing Calculator

Does your product require electronic money issuance?

This is the critical factor determining your license type. Select the option that matches your core business function.

EMI License Requirements

EMI Required: If your product requires users to store money in your system (e.g., wallets, prepaid cards, loyalty accounts).

Capital Calculator

EMIs require €350,000 initial capital + 2% of outstanding e-money.

Required Capital

€0

Key Considerations

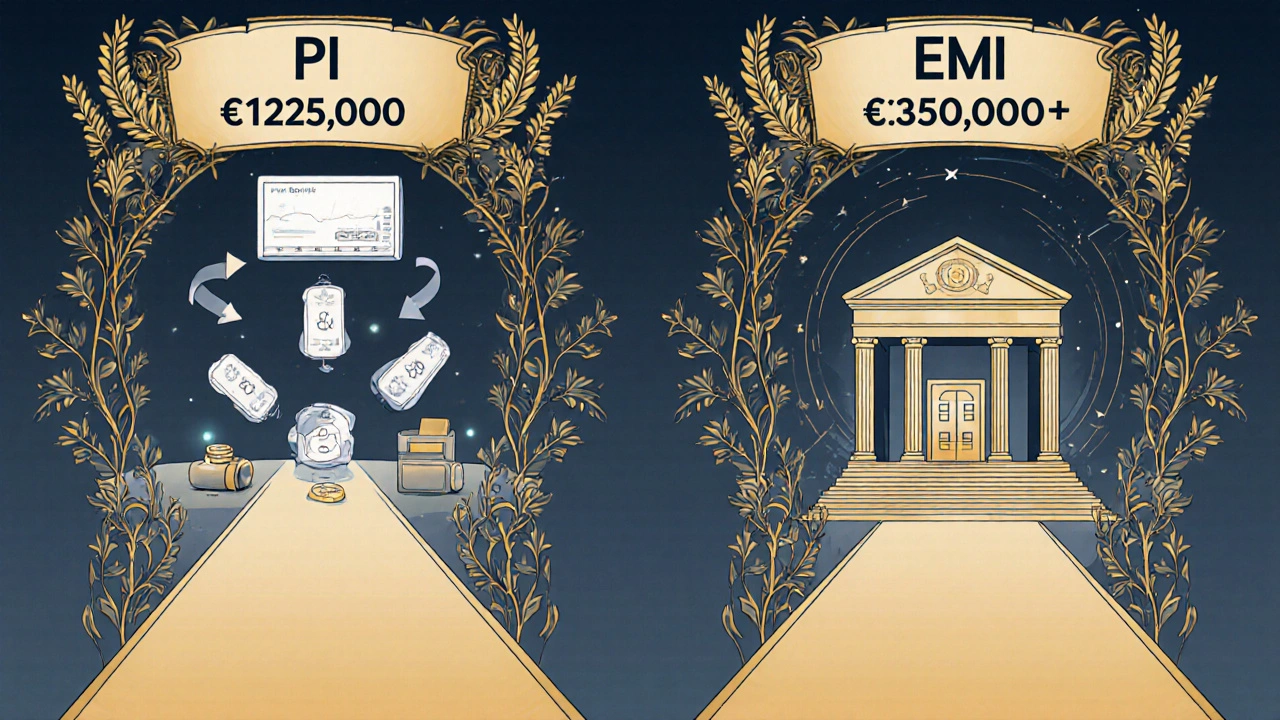

EMIs offer more revenue potential (2.7x higher per customer) but carry 37% higher compliance costs. Switching from PI to EMI later requires full reapplication, €350k+ capital, and 6-9 months of delays.

Critical Warning

Do not apply for a PI if you plan to add wallet functionality later. 41% of companies that started with PI licenses had to reapply for EMI within 2 years, costing €200k-€400k in delays and compliance rebuilds.

Final Recommendation

EMI Required

Your product requires storing customer funds.

This license allows wallet functionality but requires €350k+ initial capital.

Choosing between an Electronic Money Institution (EMI) and a Payment Institution (PI) license in the EU isn’t just about paperwork-it’s about what your business can actually do, how much money you need upfront, and how much risk you’re willing to manage. If you’re building a fintech product that handles money, this decision shapes your entire roadmap. Get it wrong, and you’ll hit a wall when you try to scale. Get it right, and you unlock real growth. Most startups think they can start small with a PI license and upgrade later. That’s true-until they realize they can’t issue wallets, prepaid cards, or stored-value accounts without an EMI. And once you’re in the market, switching licenses isn’t a simple upgrade. It’s a full reapplication, new capital, and months of delays. Let’s cut through the noise. Here’s what actually matters when comparing EMI and PI licenses under EU law.

What’s the Core Difference?

The biggest distinction isn’t in the fine print-it’s in what you’re allowed to hold. A Payment Institution (PI) is a facilitator. It moves money from point A to point B. Think of it like a digital post office: it processes transfers, direct debits, card payments, and payment initiation services. But it can’t store money on behalf of customers. If you’re building a B2B invoicing tool or a marketplace that collects payments before disbursing to sellers, a PI license is enough. An Electronic Money Institution (EMI) is a digital bank. It can do everything a PI can-but it can also issue electronic money. That means holding customer funds as a balance on a digital wallet, prepaid card, or app account. Revolut, N26, and Wise all operate as EMIs because they let users store money in their apps-not just send it. If your product needs customers to keep money in their account for later use-like a travel card, loyalty wallet, or gig economy payout account-you need an EMI. No exceptions.Capital Requirements: The Real Barrier to Entry

PIs have low entry costs. EMIs don’t. Under PSD2, a PI needs only:- €20,000 if you only do money remittance

- €50,000 if you only offer payment initiation services

- €125,000 if you offer the full suite: account services, card payments, transfers, and more

- €350,000 in initial capital-no exceptions

- Plus, ongoing own funds equal to 2% of your average outstanding electronic money

Safeguarding Rules: It’s Not Just About Separation

Both PIs and EMIs must keep customer money separate from their own. That’s non-negotiable. But how they do it differs drastically. For PIs, safeguarding under PSD2 Article 11 means:- Client funds must be held in segregated accounts

- They can’t be used for lending, investing, or operational expenses

- Regular audits are required, but no percentage-based calculations

- 100% of electronic money issued must be safeguarded

- On top of that, you must hold own funds equal to 2% of outstanding e-money

- Safeguarded funds must be held with credit institutions (banks) or invested in low-risk, liquid assets like government bonds

- Starting July 2024 (under EMD3), you must reconcile safeguarded assets daily

- Weekly independent audits are now mandatory

Who Gets Which License? Real-World Examples

Let’s say you’re building a product: - You run a SaaS platform that lets freelancers invoice clients and get paid via bank transfer. You collect payments, hold them briefly, then pay out to the freelancer. You never let users store money in your system. → PI license. - You build a mobile app where users load money to pay for rides, meals, or subscriptions. They can top up, check balances, and use a virtual card. You’re not just moving money-you’re holding it. → EMI license. Mollie, a Dutch fintech, operates as a PI. It processes payments for 200,000+ merchants but doesn’t offer wallets. Revolut and N26 are EMIs. They let users store euros, buy crypto, and spend from balances-all because they hold electronic money. The difference isn’t just technical. It’s business model. EMIs generate 2.7x more revenue per customer than PIs, according to McKinsey, because they can offer interest on balances, foreign exchange, credit products, and loyalty programs. But they also carry 37% higher compliance costs.Which Jurisdiction Should You Apply In?

Not all EU countries are equal when it comes to licensing. Lithuania’s Bank of Lithuania is the fastest. Applications take 5.2 months on average for PIs and 6.8 months for EMIs. Estonia and Malta are also popular for their streamlined processes. Germany and France are slower-up to 9.7 months-and more cautious. The UK, while no longer in the EU, remains a top jurisdiction for EMI licenses due to its mature regulatory framework. Costs vary too:- UK: EMI application fee ~£5,000; PI fee £1,500-£5,000

- Germany: EMI fee €11,900; PI fee €6,150-€8,515

What Happens If You Choose Wrong?

Aevitium’s 2023 survey found that 41% of companies that started with a PI license had to reapply for an EMI within two years because they added wallet functionality. That means:- Repaying application fees

- Scraping your compliance system

- Scrambling to raise €350,000+

- Starting the 6-9 month review process all over again

- Do I need customers to store money in my app or on a card? → EMI

- Do I only move money between accounts without holding balances? → PI

What’s Changing in 2025?

Regulators are tightening the screws. The upcoming EMD3 (effective July 2024) adds:- Daily reconciliation of safeguarded assets

- Higher liquidity coverage ratios

- Stricter governance requirements

Final Decision Framework

You don’t need to guess. Use this:- Choose PI if: You’re a payment processor, marketplace, or SaaS tool that moves money but never holds it. You’re bootstrapped or testing the market. You want speed and low cost.

- Choose EMI if: You’re building a digital wallet, prepaid card system, neobank, or embedded finance product. You want to earn interest, offer credit, or scale into lending. You have investor backing or a clear path to €1M+ in e-money issuance.

Can I start as a PI and upgrade later?

Yes, but it’s costly. You’ll need to reapply for a full EMI license, raise €350,000+ in capital, rebuild your safeguarding infrastructure, and go through another 6-9 month review. Most companies that do this spend an extra €200,000-€400,000 in delays and compliance rebuilds. Plan ahead.

Do I need a physical office in the EU to get a license?

Yes. You must have a registered office in the EU member state where you apply. Remote applications aren’t accepted. Many fintechs set up virtual offices in Lithuania or Estonia for cost efficiency, but they still need a legal address, local director, and local compliance officer.

Can a PI issue prepaid cards?

Yes, but only if they don’t store value. A PI can issue a card that pulls directly from a bank account or credit line. But if the card holds a balance you load onto it-like a gift card or travel card-that’s electronic money. Only an EMI can do that.

What happens if my EMI fails?

Customer funds are protected by safeguarding rules. Your assets must be held separately and returned to users before creditors get paid. That’s why EMIs are required to hold 100% of e-money in safeguarded accounts. But if you mismanage those funds, regulators will revoke your license-and you may face criminal liability.

How long does it take to get approved?

6-9 months on average. Lithuania is fastest (5-7 months). France and Germany take longer (8-10 months). Preparation is key: 68% of applicants fail their first submission due to weak governance plans or incomplete AML systems.

Kenny McMiller

Look, the EU’s regulatory framework is basically a cathedral of compliance-massive, ornate, and designed to collapse if you sneeze too hard. EMIs aren’t just ‘banks with apps’-they’re institutional-grade liability engines. That 2% ongoing capital requirement? It’s not a buffer, it’s a tax on growth. And daily reconciliation under EMD3? That’s not compliance, that’s a full-time treasury ops job wrapped in a regulatory bow. Meanwhile, PIs are the lean startups of finance: no baggage, no existential dread over safeguarding audits. The real question isn’t ‘which license?’-it’s ‘do you want to be a payment processor or a quasi-central bank?’ Most founders pick PI because they’re scared of the capital. Then they pivot to EMI and realize they’ve built a house on quicksand. The system rewards foresight, not hustle.

And don’t get me started on ‘virtual offices’ in Lithuania. You think having a local director means you’re compliant? You’re just outsourcing your liability to someone who’s probably got three other fintechs on their payroll. Regulators aren’t fooled. They see the IP addresses, the transaction patterns, the lack of real governance. It’s not about where you’re registered-it’s about whether your risk culture is baked into the code, not just the paperwork.